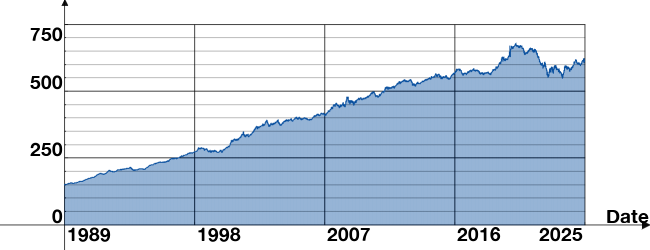

PRICE EVOLUTION:

- YTD

- 1M

- 3M

- 1Y

- 5Y

- Interval

- as per

Aggregated return during this time range :

Investment policy

The subfund DOLLARS of the bond investment fund LUXFUNDS-BOND invests its assets mainly in bonds from high-quality issuers, denominated in USD as well as in CAD.

This subfund is eligible for S-Invest, the strategy for investing in LUXFUNDS sicavs.

Aggregated return*

| YTD (02/01/2025) | 2.71% |

| for 1 month (28/03/2025) | 0.25% |

| for 3 months (28/01/2025) | 2.22% |

| for 6 months (28/10/2024) | 2.22% |

| for 1 year (26/04/2024) | 7.07% |

| for 3 years (28/04/2022) | 2.52% |

| for 5 years (28/04/2020) | -7.43% |

| as from creation (13/07/1989) | 311.47% |

Maturity structure as per 31/07/2024

Top bond investments as per 31/07/2024

| US 2.875% T-Notes Ser E-2028 18/15.08.28 | 6.36 % |

| US 4.25% Ser BC-2025 23/31.05.25 | 6.14 % |

| KFW 1.75% Sen 19/14.09.29 | 5.71 % |

| US 0.625% T-Notes Ser E-2030 Sen 20/15.08.30 | 5.65 % |

| US 4.375% Ser AG-2028 23/30.11.28 | 4.65 % |

Technical details/characteristics

| Investment fund types | Bond Funds |

| Issue date | 13/07/1989 |

| Reference Currency | USD |

| Type of shares | cap. |

| LU Withholding tax | No |

| Calculation of the net asset value | Daily |

| For every subscription today (day D) before noon (Luxembourg time), the NAV applicable will be the NAV dated today (D), which will be calculated and published the next day (day D+1), except for Sundays and holidays. | |

| ISIN code (cap.) | LU0012077920 |

| WKN number | 971729 |

| Bloomberg number | LUXDOLA |

| Cut-off time | 12:00 (GMT+1) |

CHARGES

| Entry charges | 2.50 % |

| Exit charges | 1.00 % |

| Charges taken from the fund over a year | |

| Ongoing charges | 0.96 % % |

| Charges taken from the fund under certain specific conditions | |

| Performance fee | None |

Detailed Informations about the fees and charges are in our publication concerning the main banking fees available at www.spuerkeess.lu and in our branches.

Taxation

AS AT 28/04/2025

|

|

| LU0012077920 cap. | |

|---|---|

| TIS belge | 86.24 USD |

Important notice:

Please note that the above subfund may only be distributed in Luxembourg. Shares of funds of our lux|funds range may not be sold to US Persons.

Any subscription must be done on the basis of the fund's prospectus in effect at the time of subscription and the KIID ("Key Investor Information Document"), accompanied by the latest annual report or, if more recent, the latest interim report.

For every subscription today (day D) before noon (Luxembourg time), the NAV applicable will be the NAV dated today (D), which will be calculated and published the next day (day D+1), except for Sundays and holidays.

The indicated historical performance levels are not a guarantee of similar growth in value in the future. Losses of value cannot be ruled out, and Spuerkeess may not be held liable for them. The actuarial yield represents the yield obtained when a bond portfolio is held to maturity.

The level of risk is determined on the basis of the historical performance of the last five years and should not be considered a reliable indicator of the future risk profile of the compartment. It represents the risk of fluctuations in the net asset value per share and may change over time. Level 1 represents the lowest risk, and level 7 represents the highest risk. The higher the risk, the longer the recommended investment period. For details on the risks involved, please consult the KIID.

The entry and exit charges are those indicated in the prospectus. The actual applicable charges are in our publication concerning the main banking fees available at www.spuerkeess.lu and in our branches.

Tax information about the fund is available at www.luxfunds.lu and at Spuerkeess branches. It is recommended that investors consult their own legal and tax advisers before investing in the fund.

This document is provided solely for information purposes and cannot be considered legal, tax, or investment advice.